Precision Trend History with

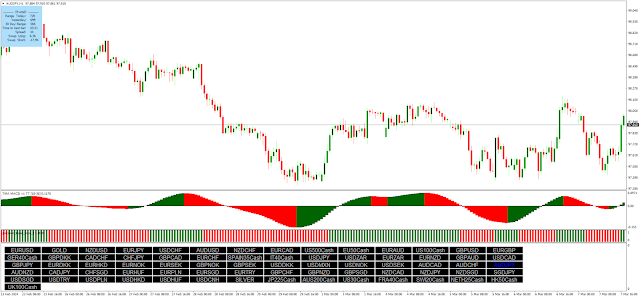

TMA Macd forex strategy is a trend following system.

Precision

Trend History indicator in the trading strategy serves as a crucial

checkpoint for validating signals generated by the TMA MACD

indicator. By incorporating this additional confirmation tool, the

strategy aims to minimize the impact of recalculating indicators,

thus bolstering the reliability of trade entries.

In the context

of financial markets, where accuracy and consistency are paramount,

the decision to integrate the Precios Trend History indicator echoes

the importance of relying on stable and dependable indicators for

informed trading decisions. Drawing parallels to weather forecasting,

where algorithms continuously adjust predictions, emphasizes the

necessity of utilizing steadfast indicators to navigate the dynamic

landscape of the forex market effectively.

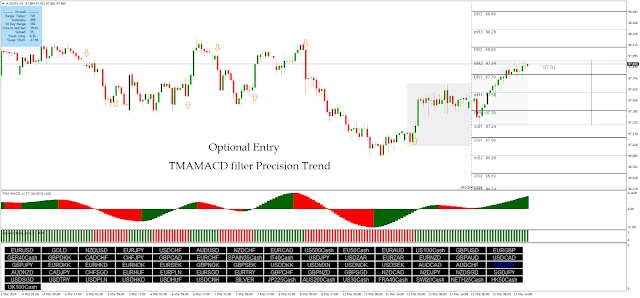

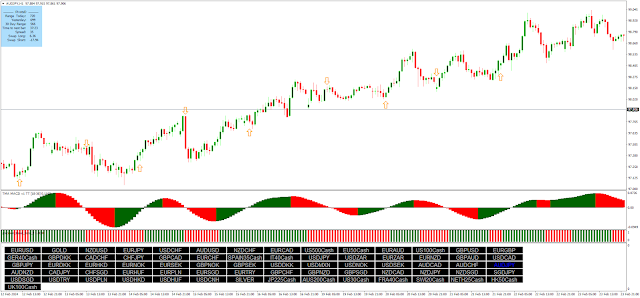

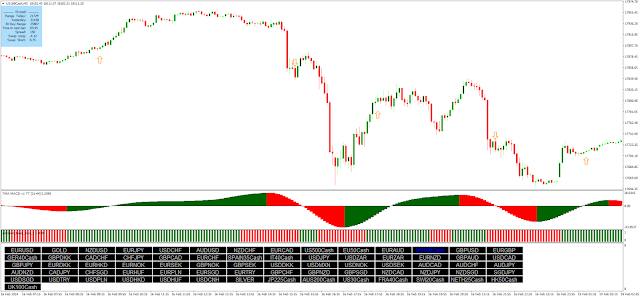

The trading setup revolves around the synergy between the TMAMACD and Precios Trend History indicators, each configured to optimize performance within the chosen time frame. By aligning signals from the TMAMACD indicator with confirmation from the Precios Trend History, traders can execute buy or sell positions with greater conviction and reduced risk.

Setup Strategy

Time

Frame 5 minutes or more.

Currency pairs: any.

Metatrader

4 indicators

TMAMACD setting 5 – 15 TF setting (21 –

44), [30-60 TF setting (18, 36)].

Precision trend (30-

2.5)

Pivot targets

Symbol Changer.

Buy signals, traders look for TMAMACD to indicate positivity, complemented by a green bar on the Precios Trend History indicator. Additional confirmation signals, such as consecutive green bars or an upward trend in TMAMACD, further reinforce the decision to enter a long position.

Sell

signals are triggered when TMAMACD displays negativity, supported

by a red bar on the Precios Trend History indicator. Optional

confirmation signals, like successive red bars or a downward trend in

TMAMACD, provide added assurance for initiating short positions.

In

terms of risk management, traders are advised to place stop-loss

orders based on previous swing highs or lows to limit potential

losses. Profit-taking targets can be determined using pivot levels or

a ratio-based approach, maintaining a favorable risk-reward balance

typically ranging from 1:1 to 1:1.5.

By adhering to these

guidelines and harnessing the combined power of the TMAMACD and

Precios Trend History indicators, traders can enhance the

effectiveness and robustness of their scalping strategy, enabling

them to navigate the forex market with increased confidence and

precision.

Download

https://drive.google.com/file/d/19lLh31gOzM5Urwb3VE4giFhiCAqAGMeG/view?usp=sharing

إرسال تعليق