Introduction

The Envelope Reversal strategy combines trend reversal and momentum trading principles, suited for day trading across various time frames. It leverages overbought and oversold areas identified by envelopes drawn on price action charts.

Setup and Strategy

Time Frame: 15 minutes or higher

Currency Pairs: Majors and Minors

Platform: MT5.

Setup and Strategy

Time Frame: 15 minutes or higher

Currency Pairs: Majors and Minors

Platform: MT5

MT5 Indicators

Envelope: Moving Average (SMA) with periods 55, close, including levels at +-80, +-310, +-340, +-550.

Stochastic (34,5,5), close.

Stochastic (55,8,8), close.

Stochastic (100,8,8), close.

Trading Rules

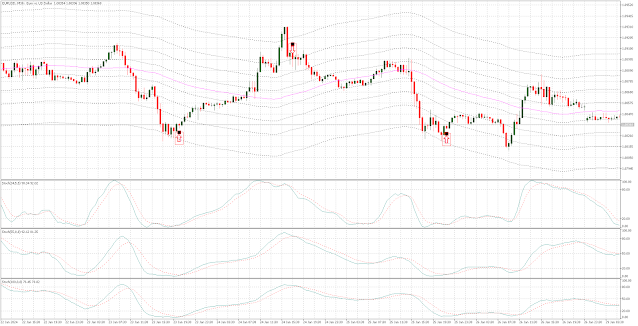

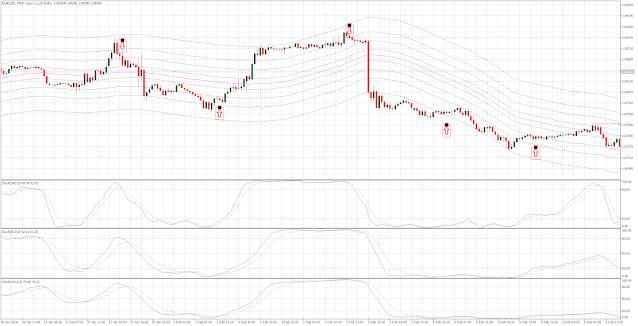

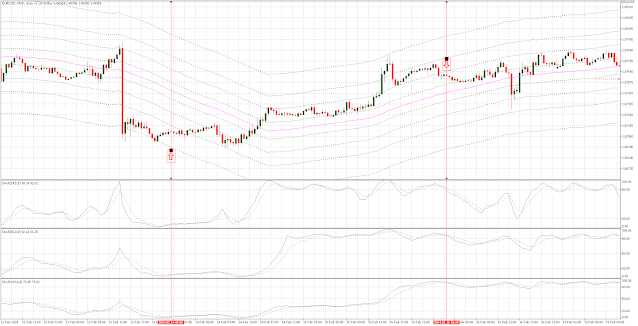

Long Entry

Price touches or breaks the penultimate or last lower band and starts retracing upwards.

All three stochastics cross upwards from the oversold area.

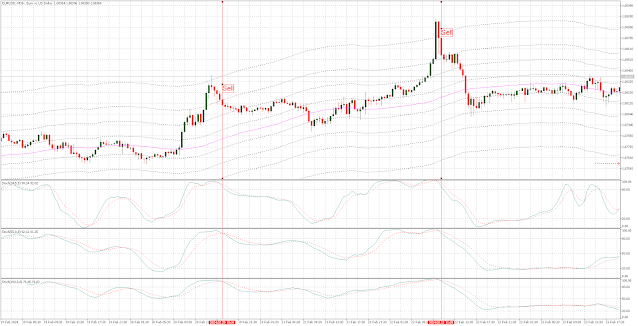

Short Entry

Price touches or breaks the penultimate or last upper band and begins retracing downwards.

All three stochastics cross downwards from the overbought area.

Exit Position

Initial stop loss set at the next band or the previous high/low level.

Profit targets include the next band, the central one, or when the stochastic crosses in the opposite direction.

Conclusion

The Envelope Reversal strategy offers a systematic approach to capitalize on trend reversals and momentum shifts in the forex market. It combines the insights from envelopes and stochastic oscillators to make informed trading decisions.

Download

https://drive.google.com/file/d/1B7MEAiM240v6ACXMvFN36hAdzuOebCdj/view?usp=sharing

إرسال تعليق