Introducing the CCI Day Trading Winninig Strategy, a streamlined approach to capturing trends in the markets with reduced noise and enhanced profitability potential. This strategy is meticulously designed for day trading on time frames ranging from 30 to 60 minutes, offering versatility across major and minor currency pairs as well as indices.

Key Components:

Indicators:

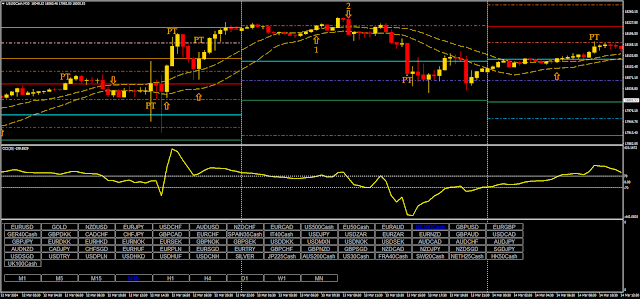

Commodity Channel Index (CCI) with a 30-period setting, emphasizing +70 for Buy signals and -70 for Sell signals.

Simple Moving Averages (SMAs) of 21 periods for both high and low prices, serving as additional trend confirmation tools.

Symbol Changer for swift identification and analysis of various trading instruments.

Trading Rules

Buy Signals

Confirmed by the price candle closing above the 21-period SMA (high).

CCI rising above the +70 threshold.

Sell Signals

Triggered by the price candle closing below the 21-period SMA (low).

CCI dipping below the -70 mark.

Exit Strategy

Initial stop-loss placement based on preceding swing highs or lows to safeguard profits.

Profit targets set at pivot point levels to capitalize on favorable market movements.

Money Management

Conservative approach involves allocating a fixed 2% of capital for each trade.

Alternatively, a more aggressive stance can be adopted using the D'Alembert method, ensuring a minimum stop-loss to profit ratio of 1:1.

In essence, this strategy harnesses the power of trend following while minimizing market noise, thereby increasing the probability of successful trades. Its robust framework, combining technical indicators with prudent risk management techniques, positions it as a reliable tool for traders seeking consistent profitability in dynamic market environments.

Download

https://drive.google.com/file/d/1-X5wKdRwnvdtX3WGyMqONJdz1X_18qZr/view?usp=sharing

إرسال تعليق