In this post, I present an illustrative instance of pair trading predicated on negatively correlated currency pairs, abstaining from mutual hedging. The primary objective of this strategy is to seize instances of directional convergence between the two pairs.

It is imperative to underscore that the delineated model holds applicability for positively correlated pairs as well. Subsequent updates to this strategy will be forthcoming.

Strategy Setup:

Timeframe: 5 minutes or higher.

Reference pairs: GBPUSD-USDCHF, GBPUSD/EURGBP, AUDUSD-USDCAD, EURUSD – USDCHF; with potential for validation and utilization of other pairs.

MetaTrader 4 Indicators:

Overlay Chart featuring the reference pairs.

Neural Hedge Overlay Chart.

Hedge Divergence Standard Deviation (optional).

Neural Hedge V3.3.

HMA 20 periods.

Trading Rules for Pairs Trading

Buy Currency1 and Sell Currency2 when:

Hedge Divergence channel is in the low band area (optional).

Neural Hedge Oscillator displays magenta bars below the lower horizontal line.

HMA buy arrow appears on currency 1.

Sell Currency1 and Buy Currency2 when:

Hedge Divergence channel is in the high band area (optional).

Neural Hedge Oscillator exhibits magenta bars above the top horizontal line.

HMA sell arrow emerges on currency 1.

Exit Position

Profit Target: Executed upon the model generating opposite conditions. Default profit example: 10 pips for a 5-minute timeframe of EURUSD USDCHF.

Neuro Hedge Oscillator reaching zero.

Stop Loss: Implemented upon the model generating contrary conditions, or following a predetermined threshold such as 15 pips for a 5-minute timeframe of EURUSD USDCHF.

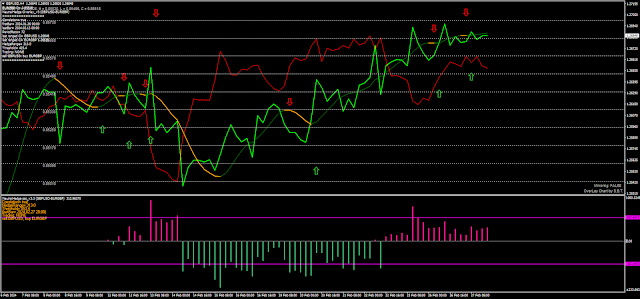

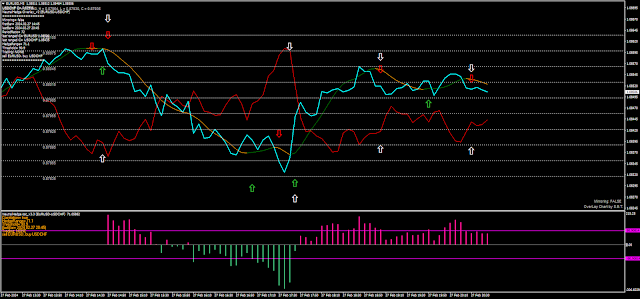

The subsequent images provide exemplar trading instances.

Reference: SwingMan

Download

https://drive.google.com/file/d/16jDAUFGmJJujq2m2Nz_GVzctq3X5K5cv/view?usp=sharing

إرسال تعليق