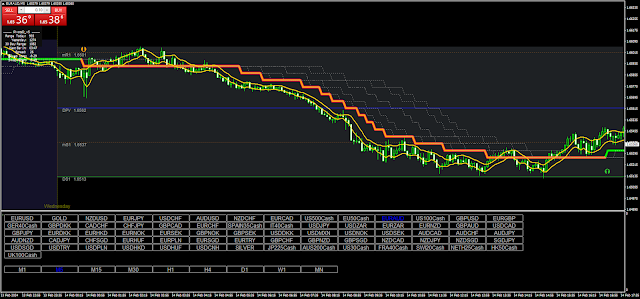

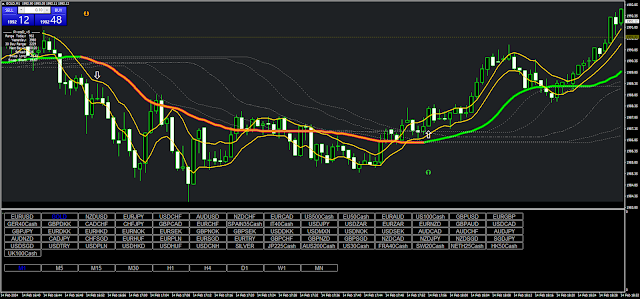

The Dynamic Zone Step Ehlers indicator is a powerful tool for trend following. Its primary objective is to filter out market noise—the erratic ups and downs commonly seen in financial instruments. In this article, we’ll explore how to leverage this indicator effectively and address the challenge of late entries.

Understanding the Dynamic

Zone Step Ehlers Indicator

1. Noise Elimination: One of

the key strengths of the Dynamic Zone Step Ehlers indicator lies in

its ability to track price movements accurately while minimizing

noise. By doing so, it helps traders focus on meaningful trends.

2. The Late Entry Issue: However, a drawback is that it sometimes

generates signals after the trend has already started. Traders may

miss out on early entry opportunities.

Resolving the Late

Entry Problem

To overcome the late entry issue, we propose a

solution: entering on retracements based on the average price of

recent bars. Here's how it works:

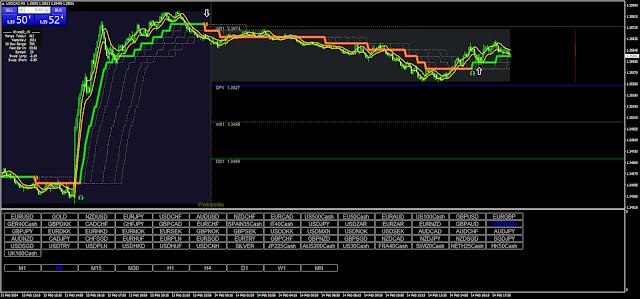

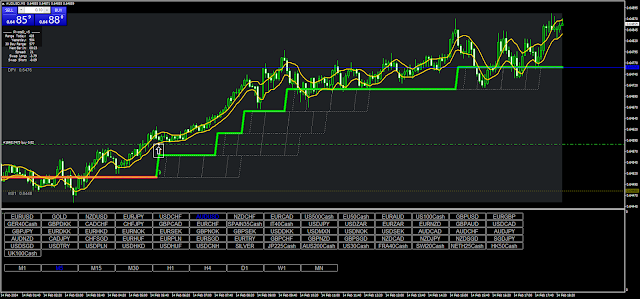

1. Channel Construction:

Start by drawing a channel based on a simple 6-period High/Low moving

average. This channel represents the average price range.

2. Signal Confirmation: When an arrow signal (buy or sell) appears on

the chart, wait for the price to retrace toward the average area

within the channel.

3. Optimal Entry: Enter the market when

the price touches or retraces into the channel average zone. By doing

so, you gain a mathematical advantage by filtering out noise.

4. Setup Strategy

• Time Frame: Consider using

the Dynamic Zone Step Ehlers indicator on time frames of 1 minute or

longer.

• Currency Pairs: This indicator can be applied

to any currency pair.

Metatrader Indicators

1.

Dynamic Zone Step Ehlers: Use the default settings for this

indicator.

2. Simple Moving Average (SMA):

◦

Period: 6

◦ High: Apply the SMA to the high prices.

◦ Low: Apply the SMA to the low prices.

Trading

Rules

Buy

◦ When a buy arrow appears,

wait for the price to retrace into the moving averages channel. You

can also consider placing a pending order.

Sell:

◦ After a sell arrow appears, wait for the price to retrace

into the channel of moving averages.

Profit Target on SR

levels or Pivot Points Levels.

Stop loss on the previous

swing high/low then it is used with trailing stop using the dotted

lines of the indicator.

It is advisable to avoid entering

after long bars.

Download

https://drive.google.com/drive/folders/1CX1PkhUY9XSf63nfjBrGXgSHA3gwz_jc?usp=sharing

إرسال تعليق