FX

Nuke Forex Strategy is a trend following that is suitable for

scalping, day trading and swing trading.

Trading

Modes Input

System

provides three different trading styles depending on your

expectations, risk appetite and experience in trading.

Trading

modes are not assigned to specific Timeframes. For example: you like

calm and secure signals for typical daytrading - you can use the

swingtrade mode (green) on the m5 or m15 interval.

FX

Nuke SCALPTRADE

It’s

characterized by the fastest signals as well as the largest potential

profit with increased risk. If you are familiar with scalping and

catching the quick market movements, you should choose this trading

mode.

Scalping

mode is recommended for advanced traders.

FXNuke

DAYTRADE

Is

the most universal mode, providing the most balanced signals.

It

provides stable signals with limited risk.

This

mode is recommended for beginners as well as experienced traders.

FXNuke

SWINGTRADE

Provides

the most secure signals, with less profit potential at the same time.

Pick this mode if you want to spend the minimum amount of time in

front of the computer.

This

mode is recommended for every type of trader.

System

overview

System

contains two indicators.

1.

Entry/Exit Colored Snake

2.

Currency strength & weakness dashboard.

Let's

take a look at the strength and weakness dashboard first.

It

presents all major currencies (EUR, USD, GBP, AUD, NZD, CAD, CHF and

JPY) in a simple visual form.

Before

you start trading on any instrument, check if the given currency is

actually

really bought / sold by the market.

Strength

& Weakness Analysis

The

market is constantly in motion, therefore there are always the

strongest (the most bought) and the weakest (the most sold)

currencies.

The

dashboard was designed to provide you with the analysis of the entire

market on one chart. In the below example, we can see that the most

bought currencies are EUR and AUD. The most sold out are USD and CAD.

EUR/USD(EUR-strong/USD-

weak)

AUD/USD

(AUD - strong/USD- weak)

EUR/CAD

(EUR-strong/CAD - weak)

AUD/CAD

(AUD-strong/CAD - weak)

If

you are dealing with such choice of pairs, it’s best to choose

those that have the lowest spread. o for example EUR/USD or AUD/USD.

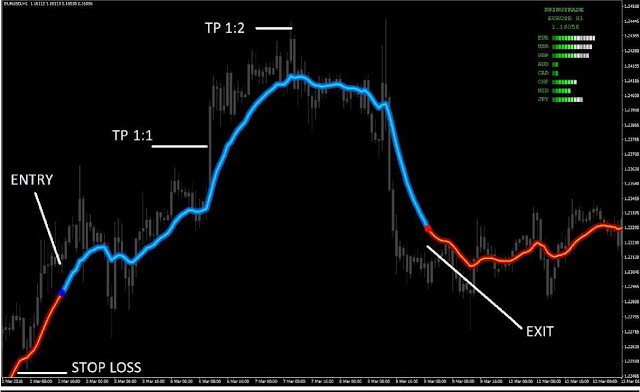

ENTRY

and EXIT Rules Let’s check the second indicator now - a colored

snake which will determine the entry and exit points.

BUY

TRADE EXAMPLE

Find

a currency pair that has a red snake. Wait for the blue dot to

appear, which will determine the

entry

(buy signal).

Transaction

should remain open, until red DOT appears.

SELL

TRADE EXAMPLE

Find

a currency pair that has a blue snake. Wait for the red dot to

appear, which will determine the entry (sell signal). When are DOT

appears it means that the market is ready for sell signal.

Transaction should remain open until the blue DOT appears.

STOP

LOSS

Stop

loss order should be placed in the technically best place:

-

the last swing high (for the SELL trade)

-

the last swing low (for the BUY trade)

The

exit signal given by the system has been designed to squeeze out the

market as much as possible and at the

same

time to secure the trader from a bigger loss.

As

for everything in forex, here we also have to pay a certain price for

such feature. It may happen

that

the exit signal eats most of the earned profit.

In

the above example, we can see that the transaction has reached over

120 pips profit before it turned back. If you are an experienced

trader and you like smaller but more secure profits, you can use a

simple risk to reward ratios. The stop loss for this transaction was

around 60pips (the last swing low). You can set a take profit order

for 60 pips (which gives risk to reward 1:1), or 120 pips (which will

produce the double stop loss value).

إرسال تعليق