The Polygon Scalper trading strategy, originally devised around two key indicators, has been enhanced to incorporate a third indicator for improved entry and exit timing. This modification aims to provide traders with a robust and straightforward approach to capitalize on trend momentum, suitable for both novice and experienced traders alike.

Strategy Configuration

Timeframe: Use timeframes of 5 minutes or higher for optimal performance.

Instrument Selection: Preferably apply the strategy to currency pairs with low spreads, such as majors and minors, along with assets like BTCUSD, ETHUSD, NASDAQ 100, and CrudeOil.

Indicators on the MetaTrader 4 platform:

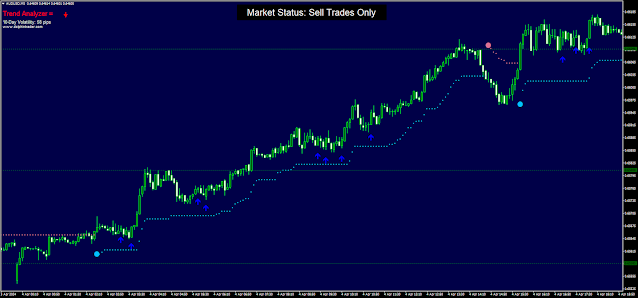

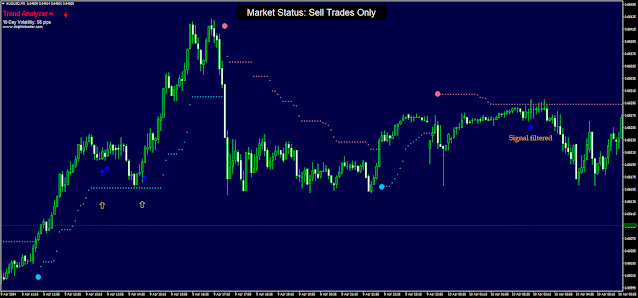

1. Polygon Trend (Sensitive 10 Periods): Identifies the prevailing market direction.

2. Polygon Scalper Arrow (Default Setting): Indicates entry timing.

3. Volty Channel Stop on Jurik ATR 3.7: Serves as a trailing stop and can be used for aggressive entry signals.

Trading Guidelines

Directional Bias: Base trading decisions on the prevailing trend identified by the Polygon Trend indicator.

Buy Signals:

Execute a buy trade when the background is colored blue, and a blue arrow appears on the chart.

Sell Signals:

Initiate a sell trade when the background is colored red, accompanied by a red arrow on the chart.

Exit Strategies

Trailing Stop: Implement a trailing stop using the Volty Channel Stop on Jurik indicator to secure profits and mitigate potential losses.

Profit Target: Aim for a profit target ratio of 1:1.2, aligning with risk management principles.

Aggressive Mode

Buy Signals:

In aggressive mode, consider entering a buy trade when the background is blue, and the Volty Channel Stop on Jurik indicator is positioned below the chart.

Sell Signals:

Likewise, in aggressive mode, initiate a sell trade when the background is red, and the Volty Channel Stop on Jurik indicator is positioned above the chart.

By adhering to these structured guidelines, traders can effectively utilize the Enhanced Polygon Scalper trading strategy to navigate dynamic market conditions with confidence and precision. This approach emphasizes simplicity, clarity, and adaptability, making it an invaluable tool for traders seeking consistent and profitable outcomes.

Download

https://drive.google.com/drive/folders/1byEz6S4xK9cjM8Yqqw1G77Ldji1KIbjM?usp=sharing

Post a Comment