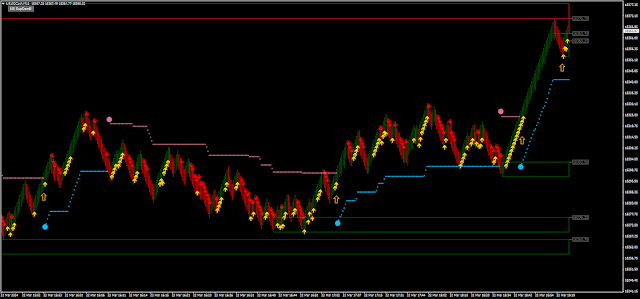

Tango Scalping strategy utilizes Median Renko charts to navigate the swift movements of volatile instruments such as the Nasdaq 100. While our example focuses on configuring the Nasdaq 100, this versatile strategy can be adapted to various other assets including the Dax, Russell, Oil, Gold , BTCUSD, Ethereum, and beyond. The foundation of this strategy rests upon three key indicators, each playing a distinct role in guiding trading decisions. Firstly, we leverage the Superdem indicator to outline crucial support and resistance zones. Next, the Tango indicator, rooted in the RSI, provides timely entry signals. Finally, the Volty Channel Stop, with its Jurik algorithm, acts as a trailing stop and directional compass. Additionally, we employ an indicator facilitating the construction of Median Renko charts within the MT4 platform.

Strategy Setup

Box Size: Set at 700 pips.

Preferred Currency Pairs: Those exhibiting volatility.

Metatrader 4 Indicators:

Superdem,

Tango (default settings),

Volty Channel Stop with Jurik,

Renko Original Chart,

Trading Rules

This strategy operates in two distinct modes: pure trend following and price action trading. For our purposes, we'll focus on price action trading.

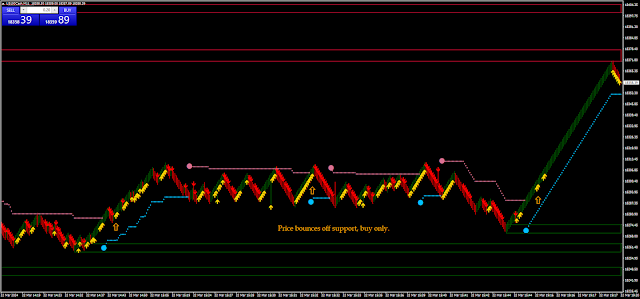

Buy Signals

Identify price bars above support levels.

Initiate Buy trades when:

The "Volty Channel Stop" indicates an uptrend (positioned below the bar).

The "Tango" indicator generates buy arrow signals within the established uptrend.

For fast scalping, consider entering retracements subsequent to red bars accompanied by buy arrow signals.

Sell Signals

Look for price bars below resistance levels.

Execute Sell trades when:

The "Volty Channel Stop" signals a downtrend (positioned above the bar).

The "Tango" indicator produces sell arrow signals within the downtrend.

Fast scalping opportunities arise when entering retracements following green bars paired with sell arrow signals.

Exiting Positions

Place Stop loss orders based on preceding high/low swing points.

Aim for a minimum profit target ratio of 1:1 to 1:2.5 compared to the stop loss.

Utilize trend-following exit methodology by observing reversals in the Volty channel's position.

Money Management

Conservative approach: Fixed risk of 2% per trade.

Aggressive method: D'Alembert progression.

This strategy offers a straightforward yet effective approach to trading volatile markets. It's advisable to begin with a larger box size, perhaps starting at 800-1000, to adapt to varying market conditions. Wishing you successful trading endeavors ahead!

Download

https://drive.google.com/drive/folders/1TjXe_4TDY9bh0NsRvCsVm48pS2dNFnm3?usp=sharing

Post a Comment