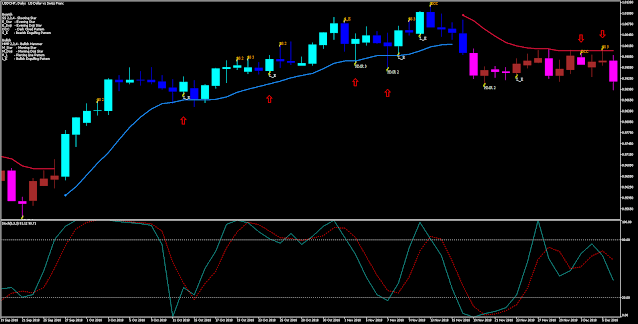

Introducing the Pattern Candlestick strategy filtered with the Parabolic Envelope, a powerful method in the world of Forex trading. This approach relies on identifying key candlestick patterns like Shooting Star, Engulfing, Doji, and Dark Cloud Cover, all while leveraging the Parabolic Envelope for trend confirmation. Assuming familiarity with these patterns, let's delve into the setup and trading rules.

Strategy Setup

Time

Frame: Preferably H1 or higher for better clarity.

Currency

Pairs: All pairs are suitable.

Indicators: Utilize MetaTrader 5

(MT5) with the following Indicators MT5

Parabolic

Envelope.

Pattern Recognition.

Symbol Changer.

Optional:

Paint Bar Momentum.

Optional: Stochastic Oscillator

(5,3,3).

Trading Rules

This strategy offers two

modes of execution: scalp trading and trend following, each with

distinct entry setups.

Buy

Confirm an uptrend

with the Parabolic Envelope positioned below the candles.

Spot a

valid buy candlestick pattern.

Enter the trade at the opening of

the next bar.

Sell

Confirm a

downtrend with the Parabolic Envelope positioned above the

candlestick.

Identify a suitable sell candlestick pattern.

Enter

the trade at the opening of the subsequent bar.

Exit Strategy

For

scalp trading on candle

Implement a stop loss at the

relative low of the preceding 15 candles.

Aim for a profit

target ratio of 0.8:1 compared to the stop loss.

For trend

trading

Set the stop loss at the previous swing, even if

it's within the same trend.

Target a profit ratio ranging from

1:1 to 1:1.5 compared to the stop loss.

Considerations

To

manage risk and minimize variance:

Limit yourself to following a

maximum of two signals, each with its own dedicated money management

approach.

Embrace these guidelines to enhance your trading

experience and navigate the Forex markets with confidence.

Download

https://drive.google.com/file/d/1yZdC5HAKMhRt6q44FO1ZRxYWxNMSE1qz/view?usp=sharing

Post a Comment