Introduction:

In the fast-paced world of forex trading, adopting a strategy that effectively filters out market noise while capturing strong trends is crucial for success. One such strategy gaining traction among traders is the Super Trend Following Strategy. Despite its seemingly complex array of filters, its objective is simple: to identify optimal entry points during strong buy or sell conditions, thus minimizing noise and maximizing profitability. With a success rate exceeding 50%, this strategy offers a promising approach to trend following, allowing for tailored money management techniques for individual traders. Let's delve into the setup and execution of this strategy.

Strategy Setup:

The Super Trend Following Strategy is designed for day trading, making it ideal for traders who prefer shorter time frames such as 30 minutes or 1 hour. It is applicable across various markets, including major and minor currency pairs, indices, commodities like gold and oil, as well as popular cryptocurrencies such as BTC, Ethereum, and Litecoin.

Metatrrader 4 Indicators:

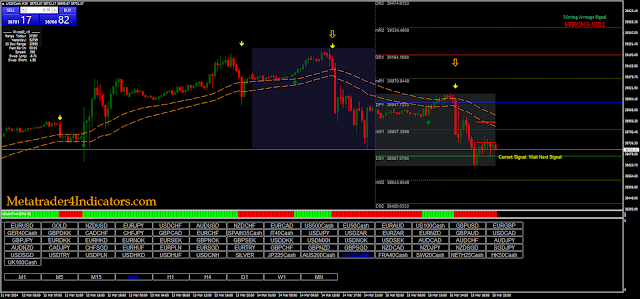

Exponential Moving Average (EMA): Utilizing EMA with a period of 50, both high and low, provides a reliable gauge of trend direction.

Aizig Signal: This modified signal indicator helps identify potential entry points, offering alerts for buy and sell signals.

Pivot Points Levels: These levels serve as additional reference points for gauging market sentiment and potential support/resistance levels.

MA Filter Signal: Acting as a supplementary filter, MA Filter Signal enhances the robustness of the strategy by confirming trend directions.

Supertrend (10, 1.5): Supertrend indicator with specific parameters aids in identifying strong trends, with green indicating a buy signal and red signaling a sell.

Trading Rules

Buy Signals

Confirm a strong buy signal when the moving average indicates a Strong Buy.

Look for Aizig buy arrow alerts, signaling potential entry points.

Ensure the closing price is above the 50 EMA high.

Confirm the Supertrend indicator displays a green color, indicating a bullish trend.

Sell Signals

Identify a strong sell signal when the moving average indicates a Strong Sell.

Pay attention to Aizig sell arrow alerts, marking potential entry points.

Verify the closing price is below the 50 EMA high.

Confirm the Supertrend indicator displays a red color, indicating a bearish trend.

Exit Strategy

Set initial stop-loss orders based on the previous swing high for buy positions and swing low for sell positions.

Aim for profit targets ranging from 1:1.25 to 1:1.5 in relation to the stop loss.

Employ a fixed money management approach of 2% per trade to mitigate risk and preserve capital.

Conclusion

The Super Trend Following Strategy offers a systematic approach to navigating the dynamic forex markets, emphasizing strong trend identification while minimizing noise. By adhering to clear entry and exit rules and leveraging a combination of indicators, traders can enhance their profitability and effectively manage risk. Whether manually executing trades or utilizing automated systems, this strategy provides a versatile framework for achieving success in forex trading.

Download

https://drive.google.com/drive/folders/1iurJYh5lvfvvxmsEcMexsbpOZ52Ggjc1?usp=sharing

Post a Comment