FIB + Dinapoli Levels Indicator MT5

It analyzes the trends in the current Market Situation. It shows where trends start and end in a separate chart window and Fibonacci retracement levels combined with DiNapoli levels on the main chart. It also displays how long ago the local high and low were detected.

Di Napoli Strategies

DiNapoli levels trading techniques

Now, let's consider trading using DiNapoli levels. In short, its basic idea described in his book allows us to develop several trading tactics with "aggressive" and "quiet" levels.

The aggressive one features two market entry methods: the Bushes and Bonsai strategies. The trading principle is similar, the only difference being the placement of stop losses.

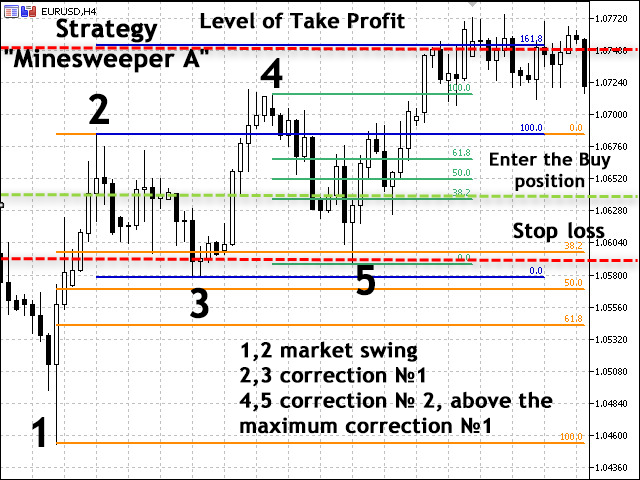

The quiet strategy also describes the two methods: Minesweeper A and B.

When applying the aggressive trading method, it is assumed that the price rolls back from the level of 38.2% and the already formed swing. The only difference between the Bushes and Bonsai strategies is the Fibo level, after which a stop loss is set.

Let's start from the Bushes trading method. According to this method, positions should be opened the moment the price on the generated corrections grid crosses the level of 38.2% in the current trend direction, while a stop loss is placed further than the level of 50%. According to the Bonsai method, the market entry is similar to the Bushes one, although a stop loss is set stop short of the Fibo level of 50%.

Following these methods is assumed to be aggressive since there is a risk that the price roll-back on the chart may not happen. It is quite common for the correction to turn into a new trend, or the price may enter flat just for a short while. Therefore, if you decide to apply this method, wait for a full confirmation of the signal to be on the safe side.

The book also describes some of the negative features of the Bonsai strategy. DiNapoli emphasizes that a considerable slippage is probable when executing a stop order in that case, since there is no powerful level meaning insufficient number of trades and no solid request matching. Thus, the choice depends on a brokerage company and a trading platform. On the other hand, if you trade highly liquid instruments with a small volume in the market, such situation is unlikely.

6. Minesweeper A and Minesweeper B strategies

The most quiet and less risky strategies are Minesweeper A and B. According to them, a market entry should be performed after a correction, while the trading itself is conducted using safety measures.

Minesweeper A. First, we wait for the initial correction to finish (no market entry), then for the second correction to form. Only after that, we open positions. A stop loss is placed the same way as in the previous strategy, i.e. behind the next Fibo level.

Minesweeper B. Instead of opening positions after the second formed correction, they are opened after the third, fourth or even later ones. In other words, we enter the market only after the trend is thoroughly confirmed meaning the risk of false signals is considerably reduced.

What are the results of the strategy? The market entries are infrequent. A trend is not always long-living enough to provide 3 or more correction moves in a row corresponding to the rules of this trading system (a roll-back end should be on the levels from 38.2% to 61.8%). On the other hand, this allows us to sort out false signals, in which the price correction does not become a continuation of a trend.

If you come across a rather long-living trend featuring multiple corrections (reactions) and follow all the analysis rules, your chart is quickly littered with many unimportant levels and lines. Most of them can be simply discarded as redundant data that do not fall under the rules for trading DiNapoli levels.

Suppose that you see a powerful uptrend with a few reactions. At some time, you have a correction of all upward movements. As a result, the price starts re-writing the Lows of some reactions. Such reactions should be canceled and their Lows should be discarded.

Reference: https://www.mql5.com/en/users/orelgrizli

Download

https://drive.google.com/file/d/1ZJ7lfg5RSBjXB3cpkvNtgMnQ7k0OECUi/view?usp=sharing

Post a Comment